Business & Loans

Five (5) Federal Government Loan Programmes That Application is Currently Ongoing in 2021

Five (5) Federal Government Loan Programmes That Application is Currently Ongoing in 2021

Are you an entrepreneur and you are looking for Federal Government Loan Programmes to apply for in order to boost your business? if your answer is yes, then you are at the right place, because we will be walking you through five Federal Government Loan Programmes that application is currently ongoing in 2021 and how to apply.

The Buhari led Government is working tirelessly to resuscitate the economy after the negative impact of the COVID-19 Pandemic last year on the income of Small and Medium Enterprise owners in the country through intervention loan programmes.

These loan programmes are focused on Youths and general MSMEs in which the Federal Government have initiated and thousands of beneficiaries have already benefited.

Some of the loan programmes such as the COVID-19 Targetted Credit Facility Loan, AGSMEIS Loan, the Non-Interest Window for COVID-19 TCF and AGSMEIS, the Anchor Borrowers Programme, and the Nigeria Youth Investment Fund have so far helped many entrepreneurs to recover from the impact of Covid-19 Pandemic.

Below are some of the Federal Government Loan Programmes whose Application is Currently Ongoing

Five (5) Federal Government Loan Programmes That Application is Currently Ongoing in 2021

1. Nigeria Youth Investment Fund

The Federal Government currently restarted the application of the Nigeria Youth Investment Fund for eligible youths who wants to take the advantage of the programme to improve themselves.

The Nigeria Youth Investment Fund (NYIF) is an N75 Billion Loan Programme initiated by President Mohammadu Buhari led administration to invest in the innovative skills and enterprise of young Nigerians.

The loan has a single-digit APR of 5% and a moratorium of 12 months before repayment. The Nigeria Youth Investment Fund was approved by Federal Executive Council in July 2020.

For More information on how to apply click here https://flippstack.com/2021/10/fg-reopens-nyif-portal-for-nigeria-youth-investment-fund-registration.html

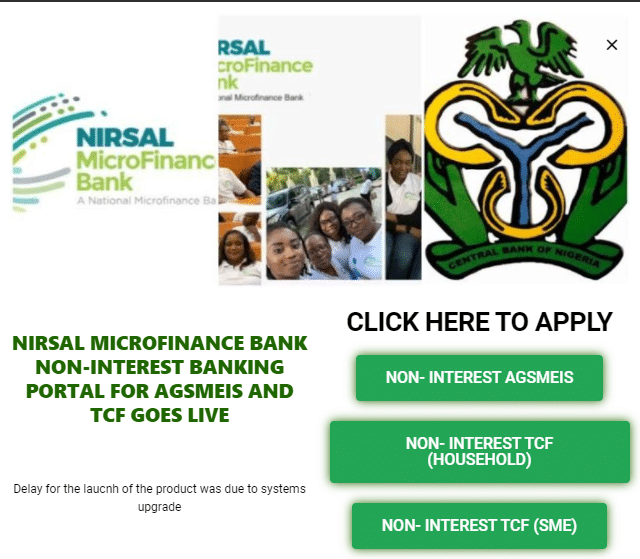

2. Nirsal Microfinance Bank Non-Interest Window Loan For COVID-19 TCF

The Non-Interest Window Loan For COVID-19 TCF was recently initiated by President Mohammadu Buhari led administration through the Central Bank of Nigeria (CBN) in corporation with Nirsal Microfinance Bank in order to extend support to businesses and households that have been impacted negatively by the Covid-19 pandemic.

The Nirsal Microfinance Bank Non-Interest Window Loan offers a financing limit of N2,500,000 worth of equipment for MSME’s and N1,000,000 for households.

All Credit Facilities which the Non-interest Banking Window of the Targeted Credit Facility TCF are for the purchase of Equipment/Goods ONLY.

For More information on how to apply click here https://flippstack.com/2021/08/nirsal-microfinance-bank-non-interest-banking-portal-goes-live.html

3. TIES Loan Programme

The Tertiary Institution Entrepreneurship Scheme (TIES Loan Programme) is focused on Nigerian Graduates and Undergraduate in any accredited University or Polytechnic in Nigeria.

The CBN N500M undergraduate and Graduates loan is created under the Tertiary Institutions Entrepreneurship Scheme (TIES), in collaboration with Nigerian universities and polytechnics to harness the potential of graduate entrepreneurs in Nigeria.

Graduates not more than 7 years of graduation are eligible to apply for up to N25 Million in the Loan Programme.

For More information on how to apply click here https://flippstack.com/2021/10/ties-loan-cbn-undergraduate-and-graduate-loan-apply-here.html

4. AGSMEIS Loan

The Agri-Business/Small and Medium Enterprise Investment Scheme (AGMEIS) is an initiative to support the Federal Government’s efforts and policy measures for the promotion of agricultural businesses and small/medium enterprises (SMEs) as vehicles for sustainable economic development and employment generation.

Applicants of this Loan Programme can access up to N10million without Collateral at 5% interest per Annum till Feb 2022 and a 9% interest rate for other years, for up to 5 years. The Moratorium is usually 12 months.

AGSMEIS Loan is currently ongoing and accessible to Entrepreneurs in various industries ranging from Agriculture to Creative, Hospitality Industries etc.

For More information on how to apply click here https://flippstack.com/2021/07/agsmeis-loan-update-fg-gives-out-loan-to-thousands-of-agsmeis-applicants.html

5. GEEP Loan

The Government Enterprise & Empowerment Programme (GEEP) is a direct effort of the Federal Government of Nigeria through the Bank of Industry to break a multi-decade jinx of economic growth without shared prosperity. It is an initiative by the Federal Government of Nigeria to provide financial inclusion and access to micro-credit for Nigerians at the bottom of the economic pyramid.

GEEP 2.0, a continuation of the Federal Government Enterprise and Empowerment Loan Programme under the National Social Investment Programme (NSIP) is ongoing.

For More information on how to apply click here https://flippstack.com/2021/08/how-to-apply-for-geep-loan-2021-22-all-you-need-to-know.html

You can also apply using the USSD code which was recently introduced by the Federal Ministry of Humanitarian Affairs, Disaster Management and Social Development for the GEEP 2.0

How to Register for GEEP 2.0

Kindly note that due to network glitches resulting from a large number of Nigerians trying to use the USSD code, error messages may occur at intervals. Applicants are advised to continue trying until it is successful.

-

Tips2 years ago

Shiloh 2022 Programme Schedule – Theme, Date And Time For Winners Shiloh 2022

-

Business & Loans2 years ago

Dollar To Naira Today Black Market Rate 1st December 2022

-

Business & Loans2 years ago

SASSA Reveals Grant Payment Dates For December 2022

-

Jobs & Scholarship2 years ago

Latest Update On 2023 NPC Ad hoc Staff Recruitment Screening

-

Business & Loans2 years ago

Npower Latest News On August Stipend For Today Friday 2nd December 2022

-

Business & Loans2 years ago

Dollar To Naira Today Black Market Rate 2nd December 2022

-

Business & Loans2 years ago

Npower N-Tech Training: Npower Praises Female Trainees

-

Jobs & Scholarship2 years ago

Latest Update On Halogen Cyber Security Competition 2023

Pingback: NPower Commences Payment Of Batch C Stream 1 October Stipend - FlippStack

Pingback: How To Easily Access CBN AGSMEIS SME Loan - FlippStack

Pingback: How To Transfer Your NMFB Loan To Your Bank Account - FlippStack

Pingback: How To Easily Access CBN EDC N10m Collateral Free Loan - FlippStack

Pingback: Latest News On Nirsal Microfinance Bank Loans For Today Tuesday 7th December 2021 - FlippStack

Pingback: How To Easily Access CBN N5 billion 100 for 100 PPP Loan - FlippStack

Pingback: Latest News On Nirsal Microfinance Bank Loans For Today Thursday 9th December 2021 - FlippStack

Pingback: Latest News On Nirsal Microfinance Bank Loans For Today Saturday 11th December 2021 - FlippStack

Pingback: Latest News On Nirsal Microfinance Bank Loans For Today Monday 13th December 2021 - FlippStack

Pingback: Latest News On Nirsal Microfinance Bank Loans For Today Tuesday 14th December 2021 - FlippStack

Pingback: Latest News On Nirsal Microfinance Bank Loans For Today 15th December 2021 - FlippStack

Pingback: Latest News On Nirsal Microfinance Bank Loans For Today 27th December 2021 - FlippStack

Pingback: FG Transport Subsidy Grant 2021/2022- N5000 Each For 40M Nigerians - Apply Here - FlippStack

Pingback: Full List Of Federal Government Grants To Apply in 2022 - FlippStack

Pingback: List Of CBN Empowerment And Entrepreneurship Options For NEXIT.

Pingback: Click Here To Apply For The CBN Creative Industry Financing Initiative (CFI) Loan - Newslineng

Pingback: NMFB Transfer Code: How To Transfer Your NMFB Loan To Your Bank Account - FlippStack