Business & Loans

How to Get Tax Identification Number Online in Nigeria

How to Get Tax Identification Number Online in Nigeria

In Nigeria and other nations, a tax identification number (TIN) is a special number used for tax purposes, and in this article, we will be walking you through how to easily get your Tax Identification Number Online.

In collaboration with the Joint Tax Board, the Federal Inland Revenue Service (FIRS), an institution of the federal government of Nigeria, is in charge of providing Nigerians with their tax identity number.

Before going into the topic of the day, let’s understand what Tax Identification Number is all about.

What is Tax Identification Number (TIN)?

A Tax Identification Number, often known as a TIN, is a special code that is assigned to people, businesses that have registered with the government, and corporations that have been formed for the purpose of paying taxes.

The so-called TINs are affectionately established by the tax authorities in order to ensure the appropriate identification, purchase, and participation of a greater number of people in the tax system.

The number is usually issued by the tax authority. through the online Joint Tax Commission portal or through a cover letter to the Federal Inland Revenue Services office closest to your location.

You may also want to read Bank USSD Code To Lock Your Account If Your Phone or Debit Card Is Stolen

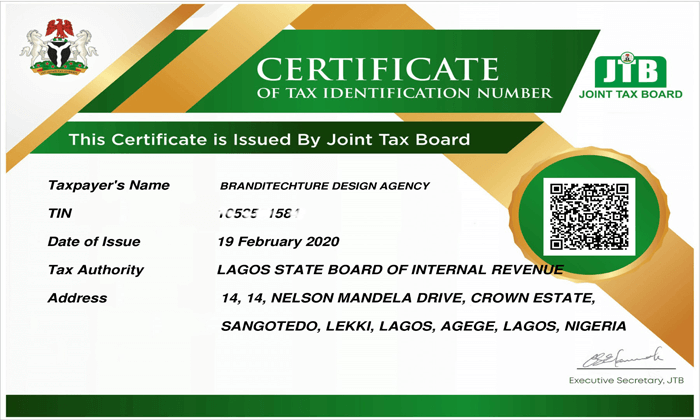

Example of Tax Identification Number

How to Get Tax Identification Number Online in Nigeria

By following the steps outlined below, you will be able to obtain this number online, either for yourself or for your company.

TIN Registration Online Process for Individuals

- To submit a personal application for a Taxpayer Identification Number (TIN), an individual needs to go to the Federal I

- land Revenue Services office that is located closest to their home in their state of residence.

- You may get the addresses and other contact information for branch offices located throughout the

- country by clicking on the following link: address info

- Pay a visit to the department’s office that is relevant to your situation in order to get an application form and a Tax Identification Number.

- Please ensure that the application form is filled out with the proper information under the applicable areas. After you have finished, you should sign it to show that it is authentic.

- After you have finished filling out the application form, you need to make sure that you have attached all of the documents that are detailed in the section of this page titled “Required documents.”

- The next step is to hand it up in person to the appropriate official at the office.

- After you have submitted your application, it, together with any supporting documents you have attached, will be sent for additional verification.

- When all of the internal procedures have been completed, the applicants will then be contacted and provided with additional information regarding the issuing of the TIN Certificate.

TIN Registration Online Process for Non-individuals

Note that the online application link is only available to organizations that are not individuals, such as Limited Liability Companies, Incorporated Trustees, Enterprises, Cooperative Societies, MDAs, Trade Associations, etc.

- The applicant needs to go to the JTB TIN Registration System by clicking on the following link in order to submit an application for a Tax Identification Number (TIN) online: You can apply online.

- After clicking on the link provided up top, navigate to the new page that loads and fill out the application form by providing the relevant information in the appropriate fields, making the appropriate selections, and submitting it.

- After you have finished, use the “Submit” button. You will be taken to the subsequent page after this one, where it is possible that you will be needed to upload the papers that are detailed in the “necessary documents” portion of this page.

- After you have followed the directions that are displayed on the screen, you can proceed to submit the online application form by selecting the appropriate option.

- After the application has been submitted, approval of the request will be granted if it is determined that all the documents and information that was provided are accurate.

- The officials will complete the necessary steps to issue the Certificate of Taxpayer Identification Number.

- In the event that this is not the case, the applicant will be contacted, advised of the deficiency, and requested to make up for it.

- The application will be considered complete, authorized, and processed for the issuance of the Tax Identification Number Certificate as soon as the applicant has properly completed it.

- When it is ready to be distributed, it will be emailed to the applicant at the address they have on file as soon as possible.

You may also want to read 6 Online Captcha Typing Jobs To Earn Upto N100k Monthly

How To Verify TIN Pin

- Visit https://apps.firs.gov.ng/tinverification/

- From the drop-down option, choose the search criterion that best suits your needs (either BVN, NIN, or registration number).

- The third step is to enter the digit that corresponds to the search criteria that you have selected. When entering your CAC registration number, be sure to use either the BN1234 or IT1234, or RC1234 format.

- The fourth step is to enter the right captcha image that is displayed.

- To validate your TIN pin, click on the search button.

-

Tips2 years ago

Shiloh 2022 Programme Schedule – Theme, Date And Time For Winners Shiloh 2022

-

Business & Loans2 years ago

Dollar To Naira Today Black Market Rate 1st December 2022

-

Business & Loans2 years ago

SASSA Reveals Grant Payment Dates For December 2022

-

Jobs & Scholarship2 years ago

Latest Update On 2023 NPC Ad hoc Staff Recruitment Screening

-

Business & Loans2 years ago

Npower Latest News On August Stipend For Today Friday 2nd December 2022

-

Business & Loans2 years ago

Dollar To Naira Today Black Market Rate 2nd December 2022

-

Business & Loans2 years ago

Npower N-Tech Training: Npower Praises Female Trainees

-

Jobs & Scholarship2 years ago

Latest Update On Halogen Cyber Security Competition 2023

You must be logged in to post a comment Login