Business & Loans

How To Apply For BAOBAB Loan 2022 | Get Instant N20,000

How To Apply For BAOBAB Loan 2022 | Get Instant N20,000

Welcome to Flippstack, In this article, we will be walking you through the full guideline on how to access the BAOBAB Loan and get an instant N20,000, so keep reading.

About BAOBAB

Baobab is a financial inclusion group focusing on serving individuals, micro and small enterprises (MSMEs) on the African continent and in China. The company’s mission is to unleash the potential of its clients by offering them simple and easy-to-use financial services. Baobab has gained recognition for its ability to combine financial sustainability with positive social and environmental impacts.

You may also want to read Agriculture Research Council Of Nigeria ARCN Recruitment 2022

Microloans – This is for entrepreneurs, traders, and students to access up to N1m for existing businesses. The interest rate charged by Baobab on loans is a minimum of 7% with the total dependent on the tenor of the loan. Microlending is the provision of financial services for people who don’t have access to traditional financial services such as banks.

The loans are aimed at individuals who were previously considered “unbankable” by larger banking institutions. These are borrowers who are possibly dealing in small amounts of money each day, living in hard-to-access areas, without credit histories, or who don’t meet “traditional requirements” within the banking sector.

How To Apply For BAOBAB Loan 2022

- visit the BAOBAB loan portal https://baobabgroup.com/ng/loans/

- Click on “Start Now”

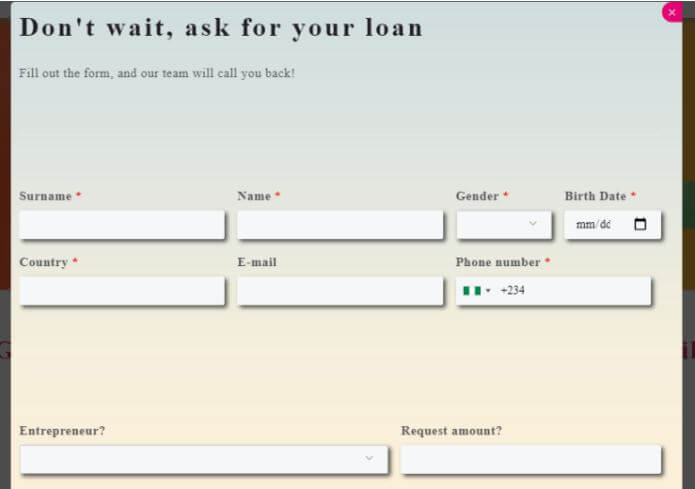

- Fill out the form

- Click “I declare” if you are above 18 years

- Then click submit

SME loans – They provide a loan of up to 20m to help consolidate or invest in your business, that is repayable in up to 24 months. The loan is for use as working capital or for the purchase of fixed assets.

BAOBAB Loan Application Form

Some Frequently Asked Questions

How Much Can I Borrow?

The minimum loan amount is N20,000 and a Maximum amount of N50,000,000. Both depend on the borrower’s repayment capacity assessed based on verifiable business inventory and other criteria.

What Type Of Loan BAOBAB Offer?

What we offer are business loans for businesses that are already in existence/operation, and housing/house improvement loans.

What are the BAOBAB Loan Requirements?

To access the BAOBAB Loan facility, you must have a business, the location must be within our bank’s lending area (Lagos state, Oyo state, and Ogun state) and it must have been in existence within a specific period.

Do I Need To Open An Account Before I Can Get a Loan?

No fee or mandatory account opening is required before you can get a loan from us.

-

Tips2 years ago

Shiloh 2022 Programme Schedule – Theme, Date And Time For Winners Shiloh 2022

-

Business & Loans2 years ago

Dollar To Naira Today Black Market Rate 1st December 2022

-

Business & Loans2 years ago

SASSA Reveals Grant Payment Dates For December 2022

-

Jobs & Scholarship2 years ago

Latest Update On 2023 NPC Ad hoc Staff Recruitment Screening

-

Business & Loans2 years ago

Npower Latest News On August Stipend For Today Friday 2nd December 2022

-

Business & Loans2 years ago

Dollar To Naira Today Black Market Rate 2nd December 2022

-

Business & Loans2 years ago

Npower N-Tech Training: Npower Praises Female Trainees

-

Jobs & Scholarship2 years ago

Latest Update On Halogen Cyber Security Competition 2023

You must be logged in to post a comment Login